41 defined benefit pension plans disappearing

Pension Plans Disappearing - CFO A new report suggests that defined benefit pension plans, under pressure on several fronts, are disappearing at an increasing pace. Traci Dority-Shanklin on LinkedIn: Defined Benefit Plans ... The next episode, "Defined Benefit Plans and the Case of the Disappearing Demographics," premiered yesterday. Steve McCourt, the co-CEO and Managing Principal at #Meketa Investment Group, returns ...

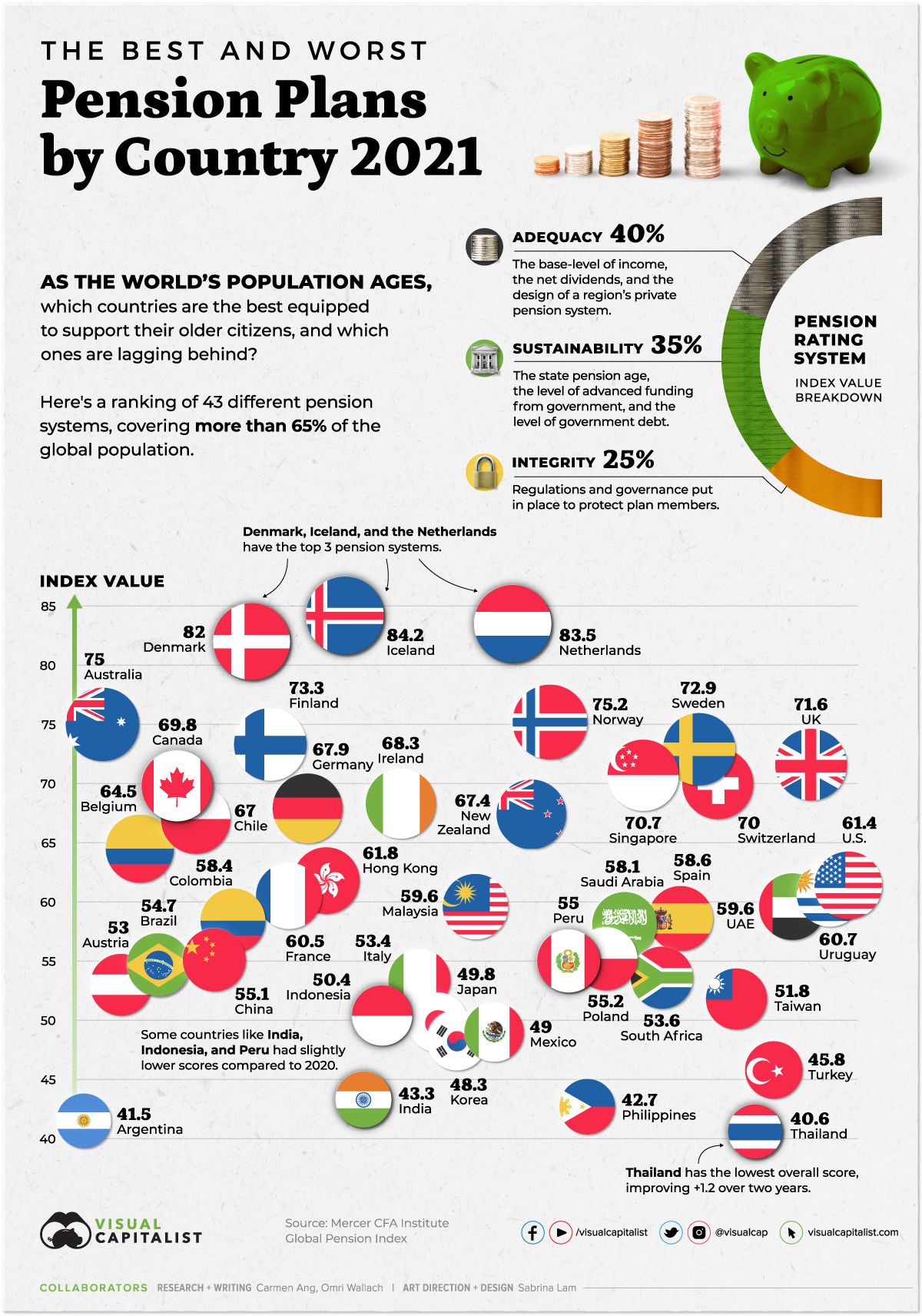

Retirement plans: Corporate pensions are dying off, Mercer ... Most U.S. companies no longer offer defined-benefit pensions, which typically provided guaranteed monthly payments to workers when they retired. But pension funds that still operate must gain in...

Defined benefit pension plans disappearing

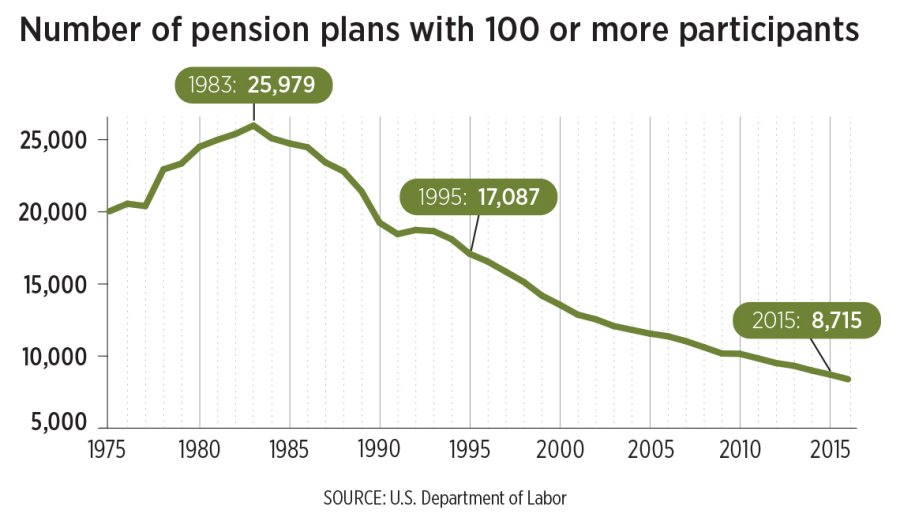

Is Your Defined-Benefit Pension Plan Safe? - Investopedia "The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement Incomes of Baby Boomers." Accessed March 16, 2021. Accessed March 16, 2021. National Association of Plan Advisors. Pensions Are Disappearing, Here's How to Save for ... If your employer promises to pay you $3,000 per month after you reach age 65, that's a defined benefit plan. Your employer made a promise to pay you a certain amount of income in retirement. The... The Disappearing DB Pension Plan - CFO Jun 28, 2019 · The Disappearing DB Pension Plan. The use of defined benefit pension plans continues to decline as sponsors look to de-risk pension strategies. Governing a defined benefit (DB) pension plan and its investment strategy has always been challenging. Over the past decade it’s also become increasingly complex, not to mention costly, spurring many ...

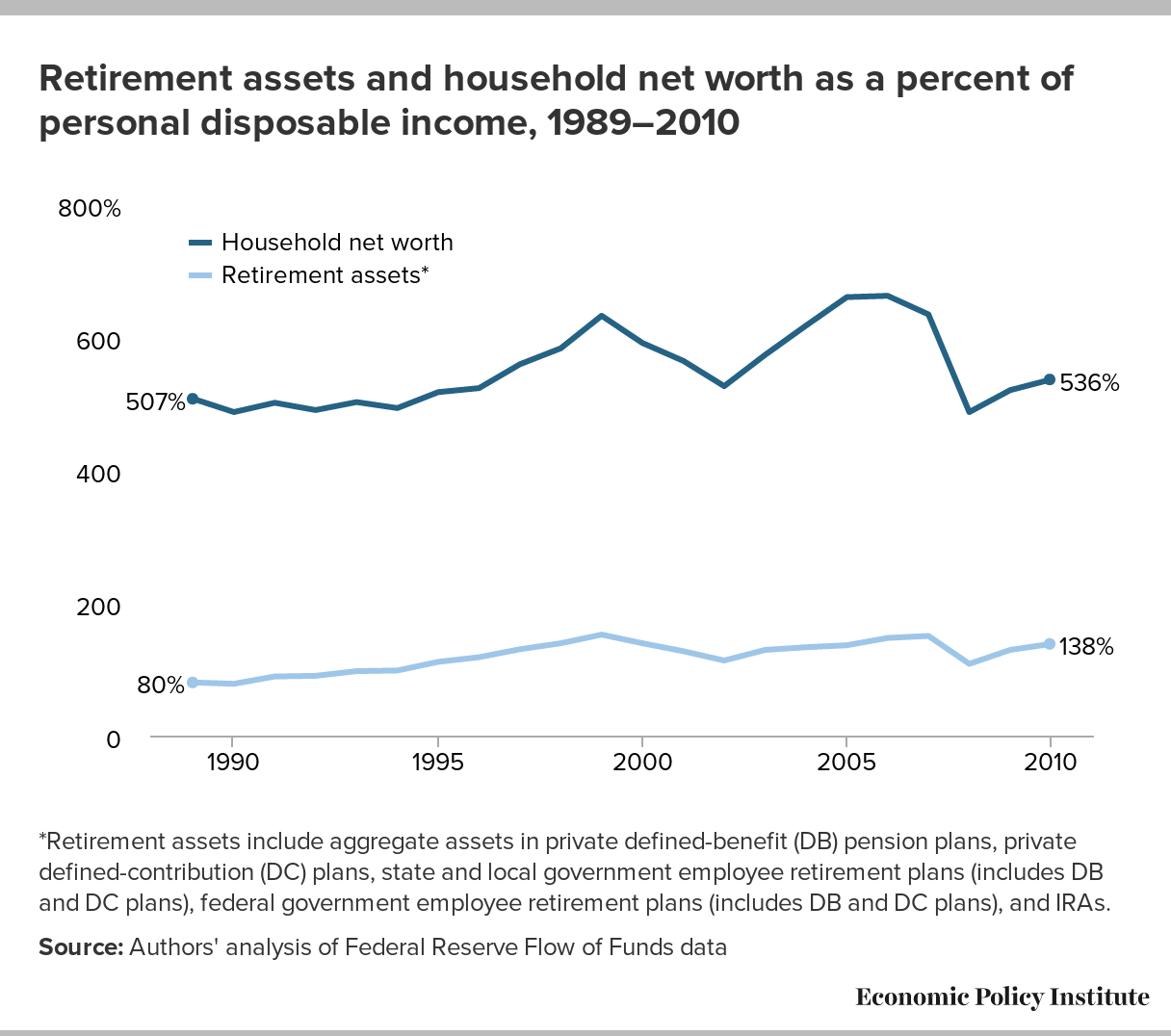

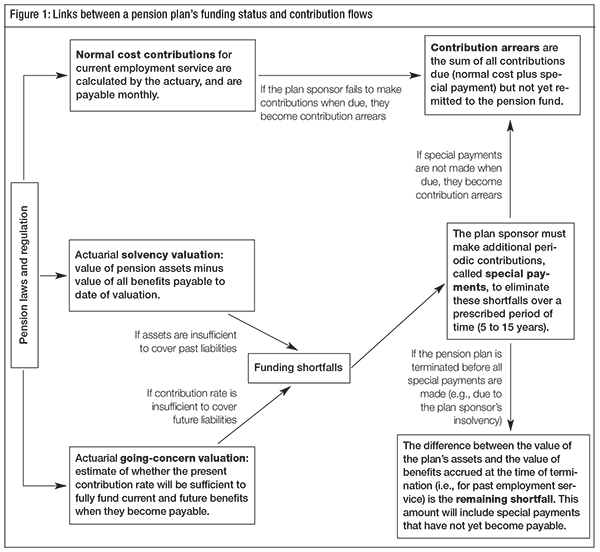

Defined benefit pension plans disappearing. The Disappearing Defined Benefit Pension and Its Potential ... Broadbent, John, Michael Palumbo, and Elizabeth Woodman. 2006. The shift from defined benefit to defined contribution pension plans—Implications for asset allocation and risk management. Paper prepared for a working group on institutional investors, global savings, and asset allocation established by the Committee on the Global Financial System. Pension Plans Continue to Fade Away. Why That ... - Barron's Overall, S&P 500 companies report about $2 trillion in defined-benefit pension obligations, down from a few years ago. Lockheed Martin bought a $1.9 billion insurance annuity covering 20,000... The Disappearing Defined Benefit Pension and its Potential ... A scenario in which employers freeze all remaining private sector DB plans and a third of all state and local plans over the next five years will on balance produce more losers than winners among boomers and reduce their average incomes at age 67. The Fed - Are Disappearing Employer Pensions Contributing ... in the case of contributory dc-type retirement plans, the answer is simple because retirement wealth is just the sum of account balances in 401 (k), individual retirement account (ira), and similar retirement saving plans. 7 those account balances are measured directly in the scf data, and thus we have the appropriate concept directly from the …

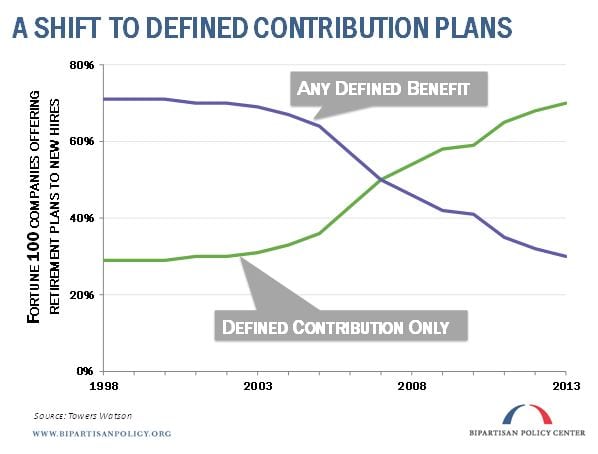

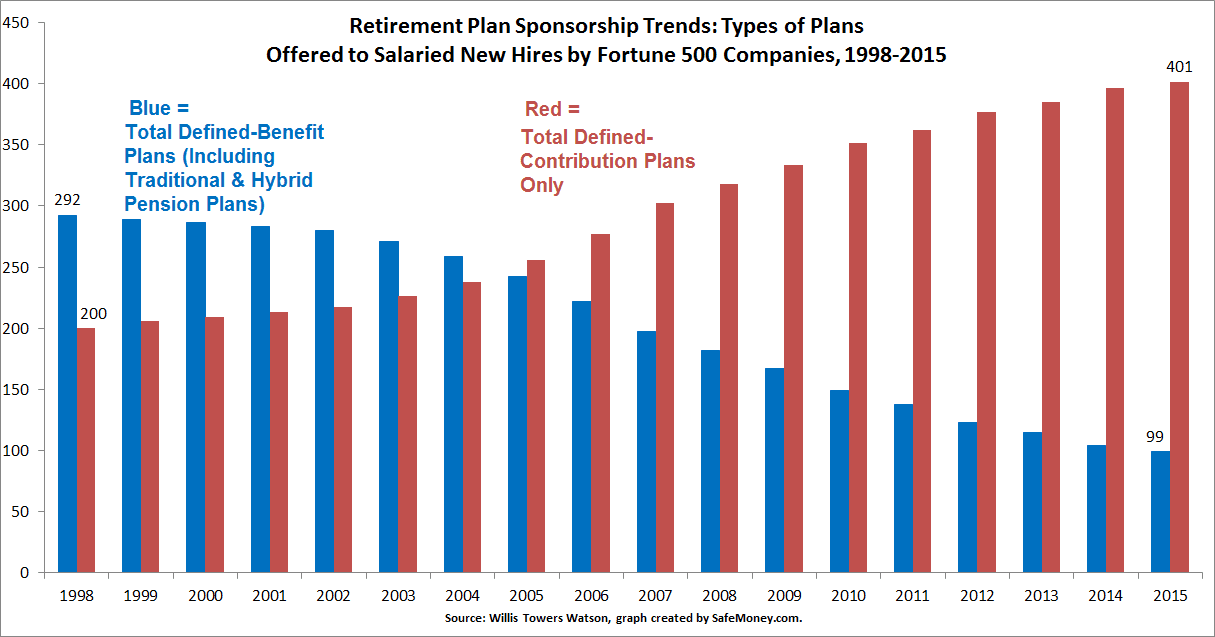

The Rise, Fall, and Complexities of the Defined-Benefit Plan Defined-benefit plans pay a guaranteed income to retired employees and are funded by employers, who choose the plan's investments. In the private sector, DB plans have been largely replaced by... DB Plans Are Not Totally Disappearing | PLANSPONSOR Data extracted by the Department of Labor's (DOL)'s Employee Benefits Security Administration (EBSA) from 2014 Form 5500 reports finds defined benefit (DB) retirement plans are not disappearing. The total number of retirement plans increased in 2014 to approximately 685,000 plans—a 0.6% increase over 2013. PDF The Disappearing Defined Benefit Pension and Its Potential ... The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement Incomes of Boomers Author: Barbara Butrica, Howard Iams, Karen E. Smith, Eric Toder Subject: Over the last three decades there has been a steady shift from DB to DC pensions. The Pension Protection Act of 2006 may accelerate this trend. Defined Benefit Plans Are Disappearing - Global Risk ... Defined-Benefit-Plans-are-disappearing.pdf Traditionally, defined benefit (DB) plans have shielded retirees from the vagaries of the stock market. However, in an effort to de-risk, many private companies and public institutions are moving to defined contribution (DC) plans.

The Case of the Disappearing Pension - Forbes The Boston College Center for Retirement Research estimates that the number of employees covered by a defined benefit retirement plan (the ones we think of as traditional pension plans) declined ... Defined Benefit Plans and the Case of the Disappearing ... Traditional defined benefit plans provide retirees with a guaranteed lifetime pension. However, workers participating in these DB plans have fallen from 38% to 20% between 1980 and 2008. The vanishing defined-benefit pension and its discontents ... The vanishing defined-benefit pension and its discontents. CHICAGO (Reuters) - If only we could revive the good old pension. You retire after 30 or 40 years at a company, get the gold watch, and ... What really happens when pensions disappear - CNBC Utah was one of many states revising or replacing their retirement plans in the wake of the 2008-09 financial crisis, which decimated many states' pension funds. A 2013 study by Boston College's ...

The disappearing defined benefit pension and its potential ... If frozen plans were supplemented with new or enhanced defined … This article uses a microsimulation model to estimate how freezing all remaining private-sector and one-third of all public-sector defined benefit (DB) pension plans over the next 5 years would affect retirement incomes of baby boomers.

Defined benefit pension plans disappearing Defined Benefit Plan Disadvantages The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. … Likewise, defined benefit packages can succumb to the pressures of costs and the volatility of investment markets. Who bears the risk in a defined benefit plan?

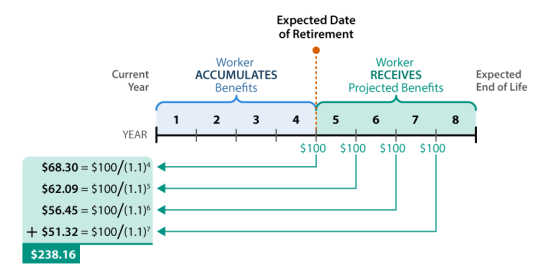

The Demise of the Defined-Benefit Plan - Investopedia Up until the 1980s, defined-benefit pensions were the most popular retirement plan offered by employers. Today, only 15% of private-sector workers have access to one, according to the March 2021 National Compensation Survey from the Bureau of Labor Statistics (BLS).2 From the employee's perspective, the beauty of a defined-benefit plan is that the employer funds the plan while the employee reaps the rewards upon retirement. Not only do employees get to keep and spend all the money they earn in their paychecks, but they can also easily predict how much money they will receive each month during retirement because payouts from a defined-benefit plan are based on a set formula.3 Of course, there are always two sides to every story. Estimating pension liabilitiesis complex. Companies offering a defined-benefit pension plan must predict the amount of money that they will need to meet their obligations to retirees. From an employer's perspective, defined-benefit plans are an ongoing liabil...

The Disappearing DB Pension Plan - CFO Jun 28, 2019 · The Disappearing DB Pension Plan. The use of defined benefit pension plans continues to decline as sponsors look to de-risk pension strategies. Governing a defined benefit (DB) pension plan and its investment strategy has always been challenging. Over the past decade it’s also become increasingly complex, not to mention costly, spurring many ...

Pensions Are Disappearing, Here's How to Save for ... If your employer promises to pay you $3,000 per month after you reach age 65, that's a defined benefit plan. Your employer made a promise to pay you a certain amount of income in retirement. The...

Is Your Defined-Benefit Pension Plan Safe? - Investopedia "The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement Incomes of Baby Boomers." Accessed March 16, 2021. Accessed March 16, 2021. National Association of Plan Advisors.

0 Response to "41 defined benefit pension plans disappearing"

Post a Comment