41 defined benefit pension vs defined contribution

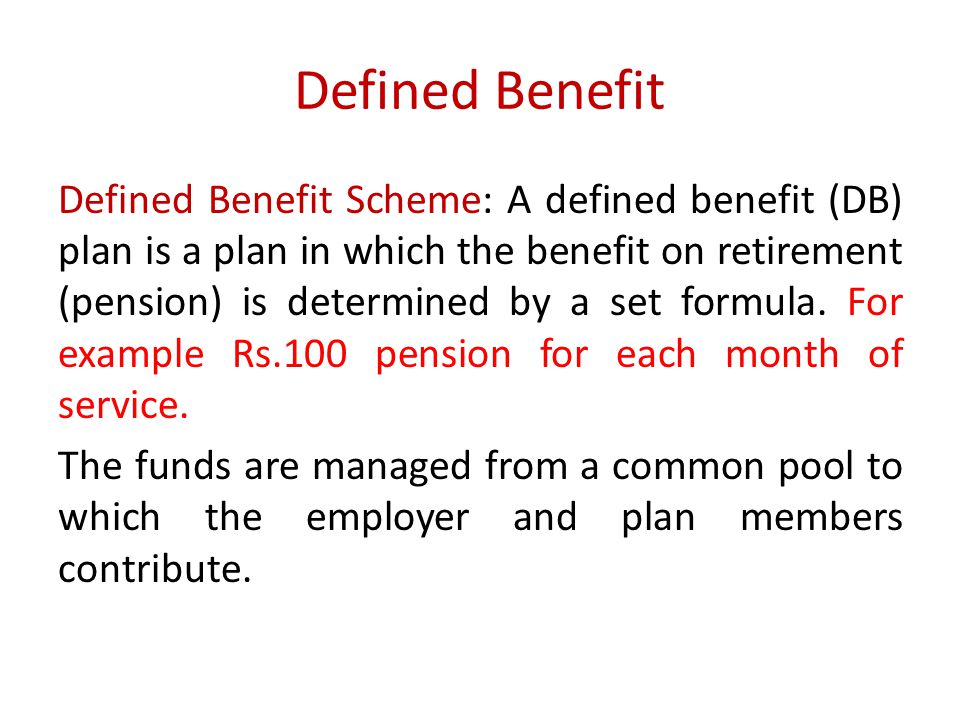

› ask › answersDefined-Benefit vs. Defined-Contribution Plan Differences Dec 12, 2021 · Employers fund and guarantee a specific retirement benefit amount for each participant of a defined-benefit pension plan. Defined-contribution plans are funded primarily by the employee, as the ... saberpension.com › 2020/07/01 › defined-benefitHow are Defined Benefit Plans Taxed? Impact ... - Saber Pension Jul 01, 2020 · However, unlike a Defined Contribution Plan, a Defined Benefit Plan provides covered employees with a retirement benefit based on a predefined formula. Defined Benefits typically are paid for by the employer, and Defined Benefit rules require employers to pre-fund pension benefits in a pooled trust account.

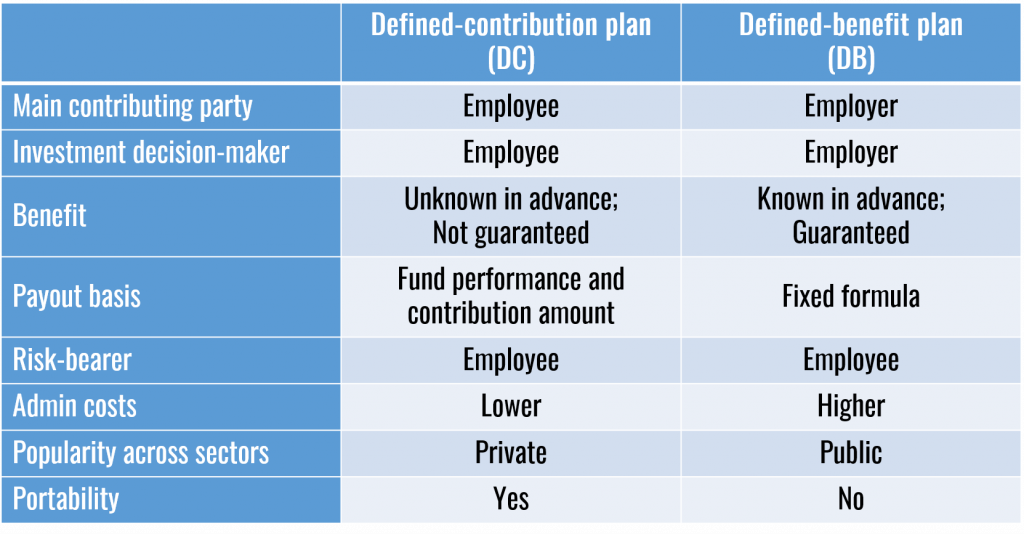

Defined Benefit vs. Defined Contribution - Which Is Better ... Defined Contribution vs. Defined Benefit Under a defined contribution plan, employees and the employer are allowed to contribute money towards the pension plan. An example of how this might work follows. An employer might contribute towards an employee's pension pot based on the latter's age, salary, and years of service with the business.

Defined benefit pension vs defined contribution

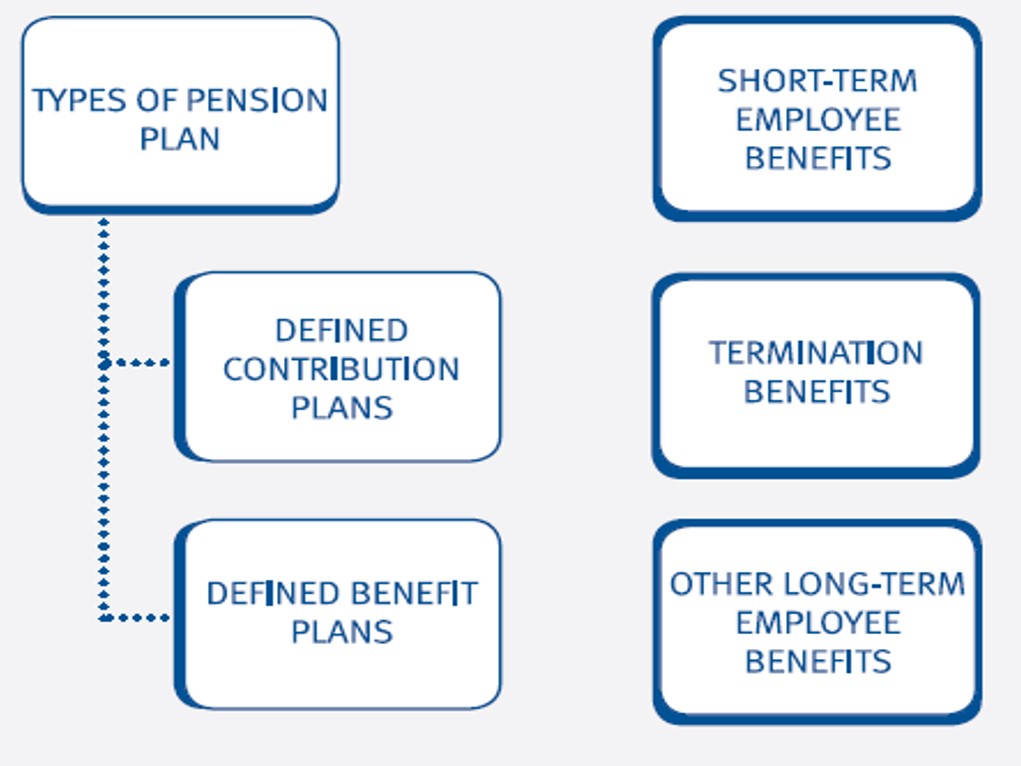

Defined benefit vs. defined contribution: What is the best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth. Defined Contribution vs Defined Benefit - Pension Plus Occupational pension Scheme (company pensions) in Ireland can generally be described as either defined benefit or defined contribution. (DB or DC) Defined Benefit (DB) schemes Defined benefit schemes aim to provide a set level of pension and/or lump sum at retirement. What Is a Defined Benefit Plan? | The Motley Fool A defined benefit plan is very different from a defined contribution plan. Find out here how a defined benefit plan works.

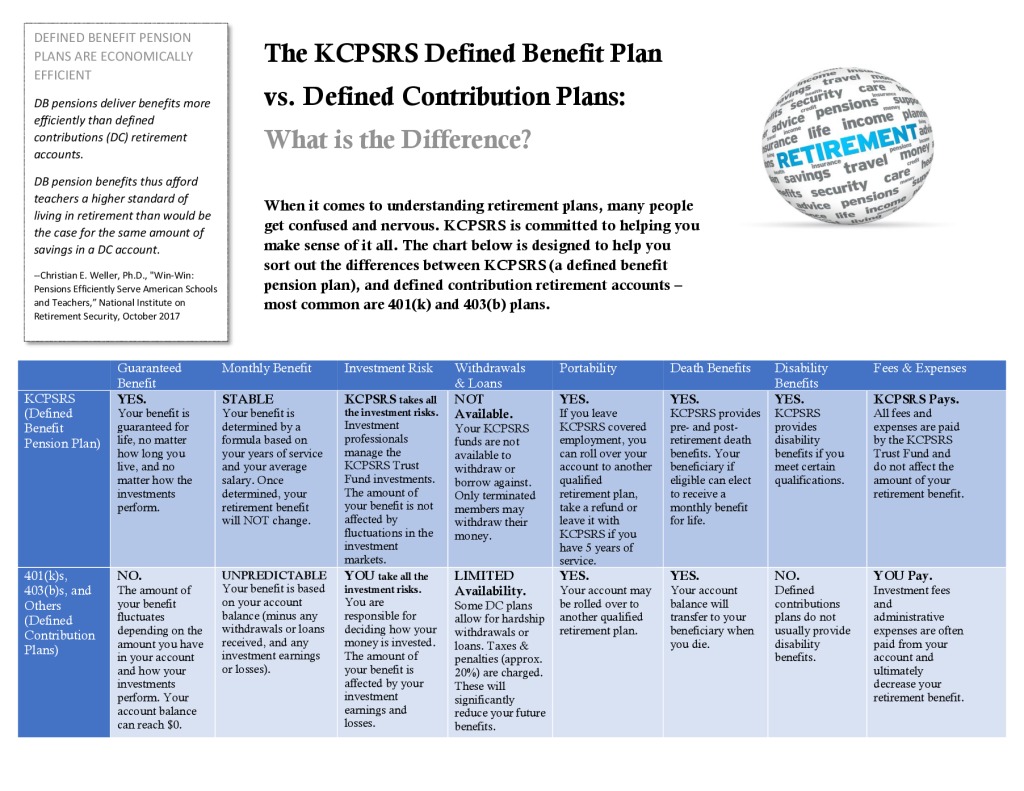

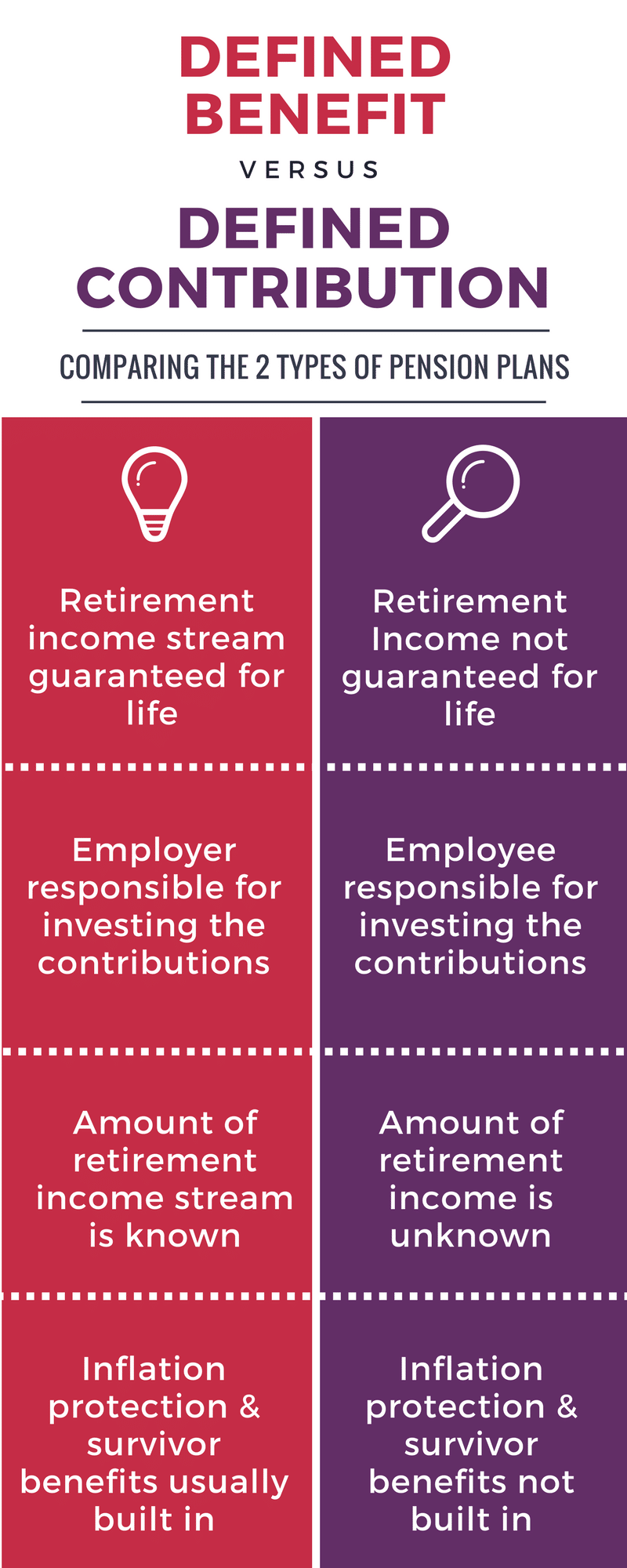

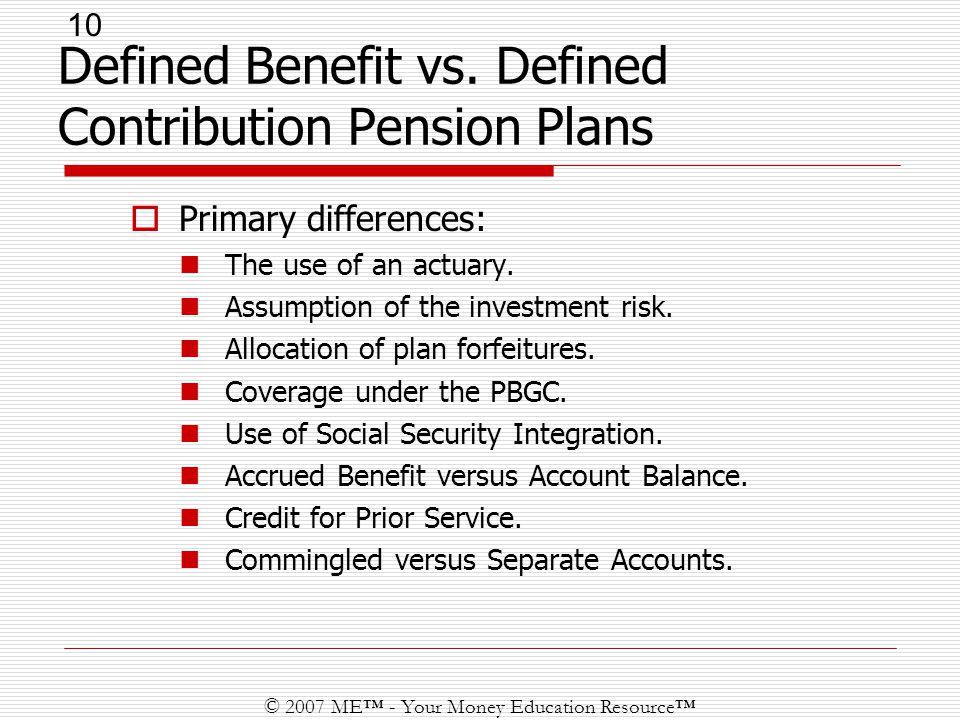

Defined benefit pension vs defined contribution. Defined Benefit vs Defined Contribution Pension Plans ... The main differences between a defined benefit and defined contribution pension plan are who funds it, who manages it, and whether or not it pays out a predetermined amount. Hannah Logan At the end... Defined benefit vs. defined contribution - Ontario Pension ... PSPP defined benefit. Defined contribution. You have guaranteed income for the rest of your life. Your pension is guaranteed by the Government of Ontario. You may outlive your pension. Your pension stops when your savings are depleted, unless you buy a life annuity. Your pension is managed by a team of investment experts. Defined Benefit vs. Defined Contribution | Workforce.com Defined Benefit vs. Defined Contribution. By Kelly VanDerhei. Dec. 1, 1998. Two of the most common terms used in describing retirement plans are "Defined Benefit" (often thought of as traditional pensions) and "Defined Contribution" (often thought of as 401k) plans. This chart should help you compare the two. Defined Benefit vs. Defined Contribution: What Is the Best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth.

Difference Between Defined Benefit and Defined ... the key difference between defined benefit pension and defined contribution pension is that a defined benefit pension is a pension plan in which an employer contributes with a guaranteed lump-sum on employee's retirement that is determined based on the employee's salary history and other factors whereas a defined contribution pension is a savings … Defined Benefit Vs. Defined Contribution Retirement Plans Whereas the emphasis of defined benefit plans is on the payout, the emphasis on defined contribution plans is on the contribution (via employee or employer via a 401K match) - and this is the #1 distinguishing characteristic between the two. Secondly, individuals own the funds, once contributed. The Rise, Fall, and Complexities of the Defined-Benefit Plan Defined-benefit plans have lost ground to defined-contribution plans in recent decades, and their complexities—in particular, estimating pension liabilities—are part of the reason. Defined Benefit vs. Defined Contribution ... - MWRA Retirement Defined Benefit vs. Defined Contribution Plans: Understanding the Differences Both defined benefit (DB) and defined contribution (DC) pension plans offer various advantages to employers and employees. The features of each are generally distinct and quite different. Defined Benefit Plans

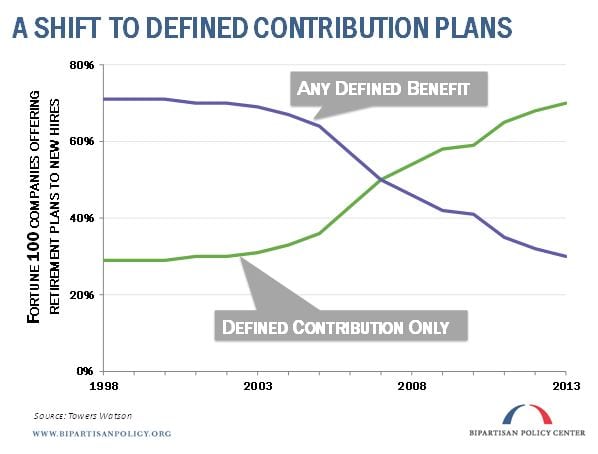

Teacher Retirement: Defined Benefit vs Defined Contribution Defined benefit pension plans provide a fixed monthly payment for the rest of one's life based on income and years of service. Teachers are already underpaid in comparison to comparable professionals. One of the incentives for teachers to continue in the classroom has been a comfortable retirement. 2. Defined Contribution Plans. Defined Benefit Vs. Defined Contribution Pension Plans ... Defined benefit and defined contribution are the two main types of employer retirement plans. Defined benefit plans were at one time the mainstay of company retirement plans but are not as popular as they used to be. Defined contribution plans are becoming more common, because they are less expensive for employers to administer. Defined Benefit Retirement Plans vs. Defined Contribution ... Updated: May 1, 2019. Issue: An ongoing debate in Illinois state government and throughout the country revolves around whether Defined Contribution retirement plans (DC plans) are generally better for benefit recipients, more efficient and more cost effective for governments to operate as opposed to Defined Benefit retirement plans (DB plans). ). Currently, the majority of government-sponsored ... saberpension.com › 2019/07/25 › defined-benefit-planDefined Benefit Plan Rollover to an IRA. What ... - Saber Pension Jul 25, 2019 · Direct Rollover vs. 60-Day Rollover. There are two ways to rollover a Defined Benefit distribution: a direct rollover or a 60-day rollover. As the name implies, a direct rollover is when the Plan paying the distribution makes a direct transfer to the IRA or employer plan receiving the funds.

PDF Defined contribution retirement plans: Who has them and ... In 1988, when defined contribution retirement plans were a fairly new concept in the workplace, Bureau of Labor Statistics (BLS) Commissioner, Janet L. Norwood wrote, "It is unclear whether the more rapid growth in defined contribution plans compared to defined benefit plans is a movement towards variable rather than fixed payments.

What is a Defined Benefit Pension Plan? - DBA The difference between defined benefit and defined contribution pension plans is that, instead of providing a defined income after retirement, a defined contribution plan empowers an employee to contribute a fixed percentage of their income to their benefit. The employer then deposits that contribution on their behalf.

Defined Benefit Vs. Defined Contribution Pension Plans ... While fewer companies are offering a defined benefit plan, it is still important to understand the difference between a defined benefit and defined contribution pension and how that difference may...

› pensions-retirement › faqsDefined Benefit vs Defined Contribution (Difference) | Zurich ... The main difference between a defined benefit scheme and a defined contribution scheme is that the former promises a specific income and the latter depends on factors such as the amount you pay into the pension and the fund's investment performance. When choosing a pension, there are numerous pension plan options available.

Registered Retirement Savings vs. Registered Pension: What ... 29.6.2021 · In defined benefit plans, the pension amount is known and does not change, but the contribution amount varies. These plans do not have a yearly maximum contribution limit.

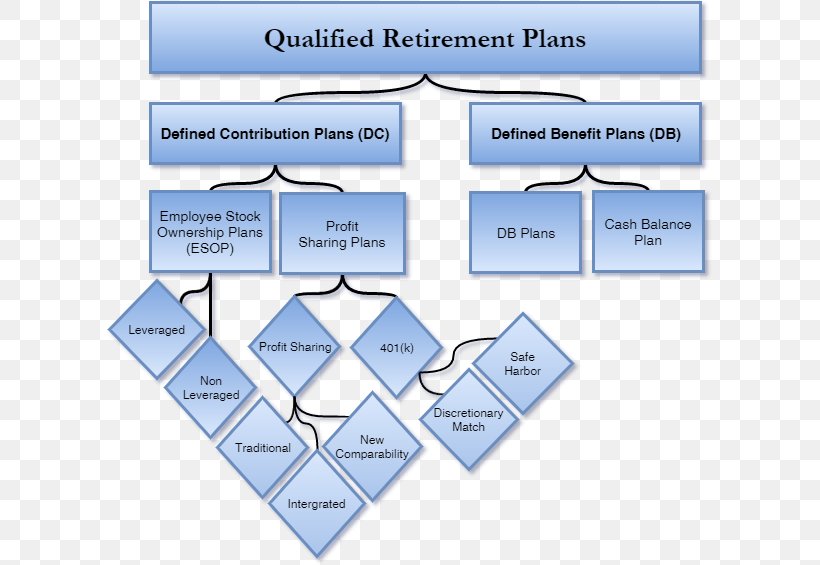

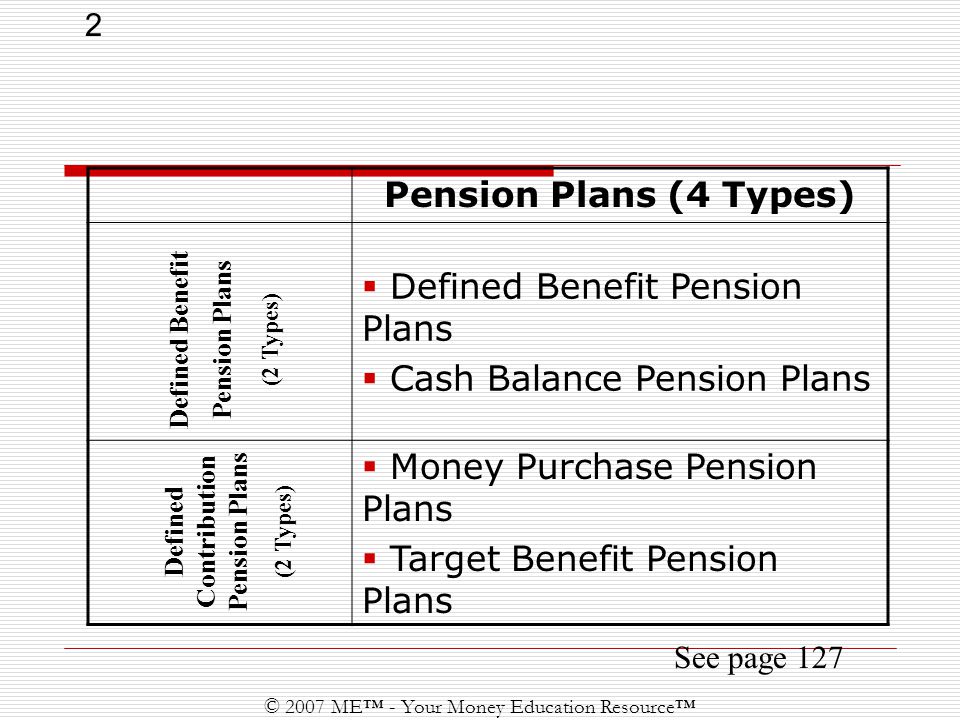

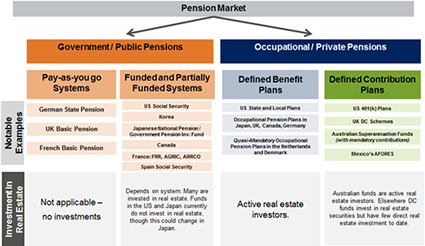

Defined Benefit vs. Defined Contribution: Choosing the ... In general, defined benefit (DB) plans come in two varieties: traditional pensions and cash-balance plans. Examples of defined contribution (DC) plans include 401 (k) plans, 403 (b) plans, employee stock ownership plans, and profit-sharing plans.

What are defined contribution and defined benefit pensions ... If you've got pensions savings outside of the state pension, they'll either be defined benefit (DB) or defined contribution (DB). Both kinds have the same tax benefits when saving for retirement, but there are big differences in terms of what you'll get out at the end.

Defined Benefit vs Defined Contribution Pension - Money We ... Instead of having a fixed retirement payout, a defined contribution pension plan offers a matching contribution up to a certain amount. This is nowhere near as valuable as a defined benefit pension plan, but it's still free money so try to max out your plan. In addition, it's up to you as the employer to select what investments you want.

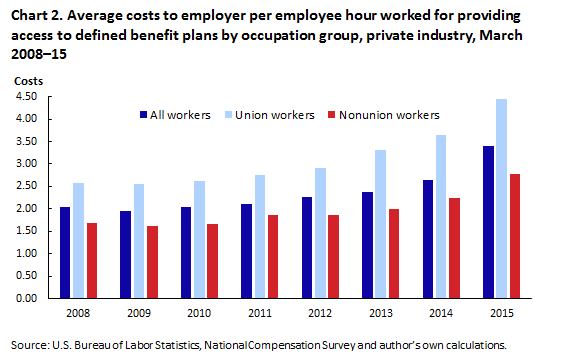

Defined Benefit vs. Defined Contribution: Understanding ... The Bureau of Labor Statistics (BLS) finds, for civilian workers, the employer cost for defined benefit plans amounts to 3.2% of total compensation paid, while employer costs for defined contribution plans are 2% of total compensation.

› pensions-explained › pensionWhat is a defined benefit pension? | Final salary pension Defined contribution vs. defined benefit pensions While the amount of money your defined contribution pension is worth on retirement depends on how much you've paid in and how your investments have performed, the value of a defined benefit pension is based on: How long you've worked for the company

Defined Benefit Plan vs Defined Contribution Plan | What ... Welcome to the Morning Ride Wealth Guide. This is where we cover quick tips on your morning trip, for all things related to your wealth and retirement. These...

Defined-Benefit vs. Defined-Contribution Plan · Know ... Defined benefit plans are what most of us would think of as a traditional pension plan. Defined contribution plans include the popular 401 (k) plan as well as 403 (b) and 457 plans. Due to a number of factors including cost, defined contribution plans have replaced defined benefit as the retirement plan of choice for many employers.

Pension vs 401(k) - Forbes Advisor 10.12.2020 · A pension guarantees you retirement income, while a 401(k) plan depends on your own contributions and investments. If you’re lucky enough to be deciding between these two retirement options ...

advisory.kpmg.us › articles › 2019Defined benefit plans: IFRS® Standards vs. US GAAP Defined benefit vs. defined contribution plans under IFRS Among employers, there has been a general movement away from defined benefit plans and toward defined contribution plans in recent years. 4 In 2019, only 16% of private sector workers in the United States have access to a defined benefit plan, while 64% have access to a defined ...

Defined Benefit Pension vs Defined Contribution Pension ... Defined Contribution Pension (DCP) Instead of the benefit being fixed, a defined contribution pension plan has a fixed contribution usually based as a percentage of the employees salary (usually employer matched). The benefit is dependent on how the portfolio performs with no guarantees as to how much income you'll receive during retirement.

Defined-Benefit Plan - Overview, Formulas, Pros and Cons Defined-Benefit Plans vs. Defined-Contribution Plans Similar to a defined-benefit plan, defined-contribution plans Defined-Contribution Plan A defined-contribution plan (also known as a DC plan) is a type of pension fund payment plan to which an employee, and sometimes an employer, are another type of employer-sponsored retirement savings plan.

Defined-Benefit Plan 24.4.2021 · Understanding Defined-Benefit Plan . Also known as pension plans or qualified-benefit plans, this type of plan is called "defined benefit" because employees and employers know the formula for ...

› defined-benefit-pension-explainedDefined Benefit Pension Plan Canada: The Ultimate Guide ... Mar 01, 2021 · Defined benefit pension plan Canada: The ultimate guide from someone who actually has a defined benefit pension plan (yours truly). Oftentimes I think of my defined benefit pension plan (DBP) is like a Set for Life Scratch & Win– except that I would have to work for another 20 years to be ‘set for life’ and have a full pension which really, would not be ideal, nor would it be the Fat ...

What Is a Defined Benefit Plan? | The Motley Fool A defined benefit plan is very different from a defined contribution plan. Find out here how a defined benefit plan works.

Defined Contribution vs Defined Benefit - Pension Plus Occupational pension Scheme (company pensions) in Ireland can generally be described as either defined benefit or defined contribution. (DB or DC) Defined Benefit (DB) schemes Defined benefit schemes aim to provide a set level of pension and/or lump sum at retirement.

Defined benefit vs. defined contribution: What is the best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth.

/WorkRetirement-56eeac473df78ce5f8395f69.jpg)

0 Response to "41 defined benefit pension vs defined contribution"

Post a Comment