42 defined contribution pension death

Defined Contribution Pension Plan Death Benefit Application Defined Contribution Pension Plan Death Benefit Application _____ Complete all applicable sections and return pages 1-3 to: Southern California Pipe Trades Administrative Corporation Defined Contribution Department 501 Shatto Place, 5th Floor Los Angeles, CA 90020 Save “Your Rollover Options” for your records. (800) 595-7473 OR (213) 385-6161 Benefits payable on death - The Pensions Authority One of the important benefits often associated with pension arrangements is the availability of benefits payable on or after your death.

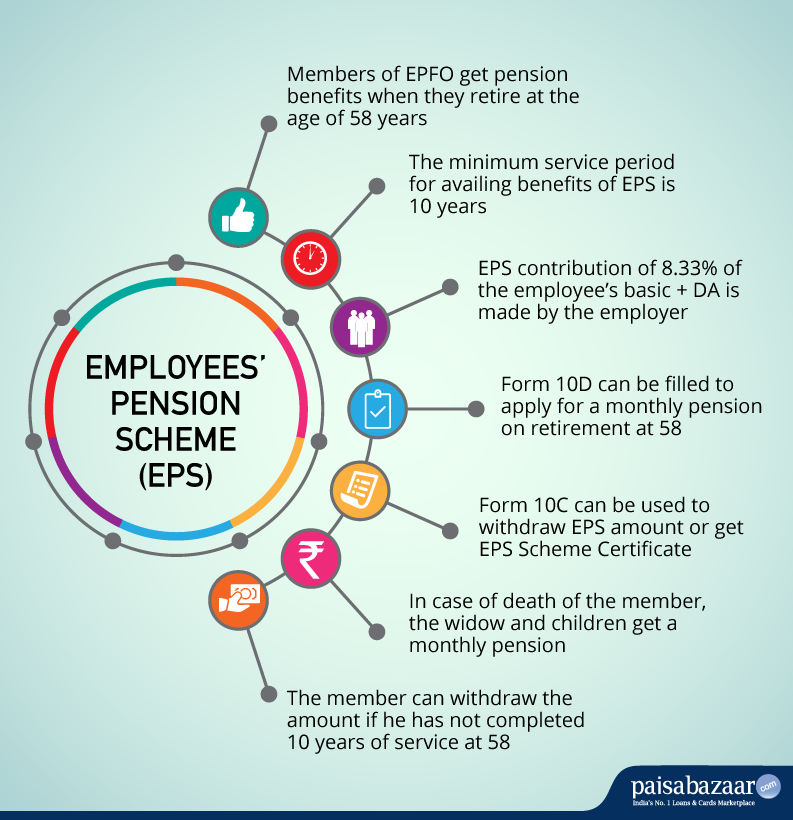

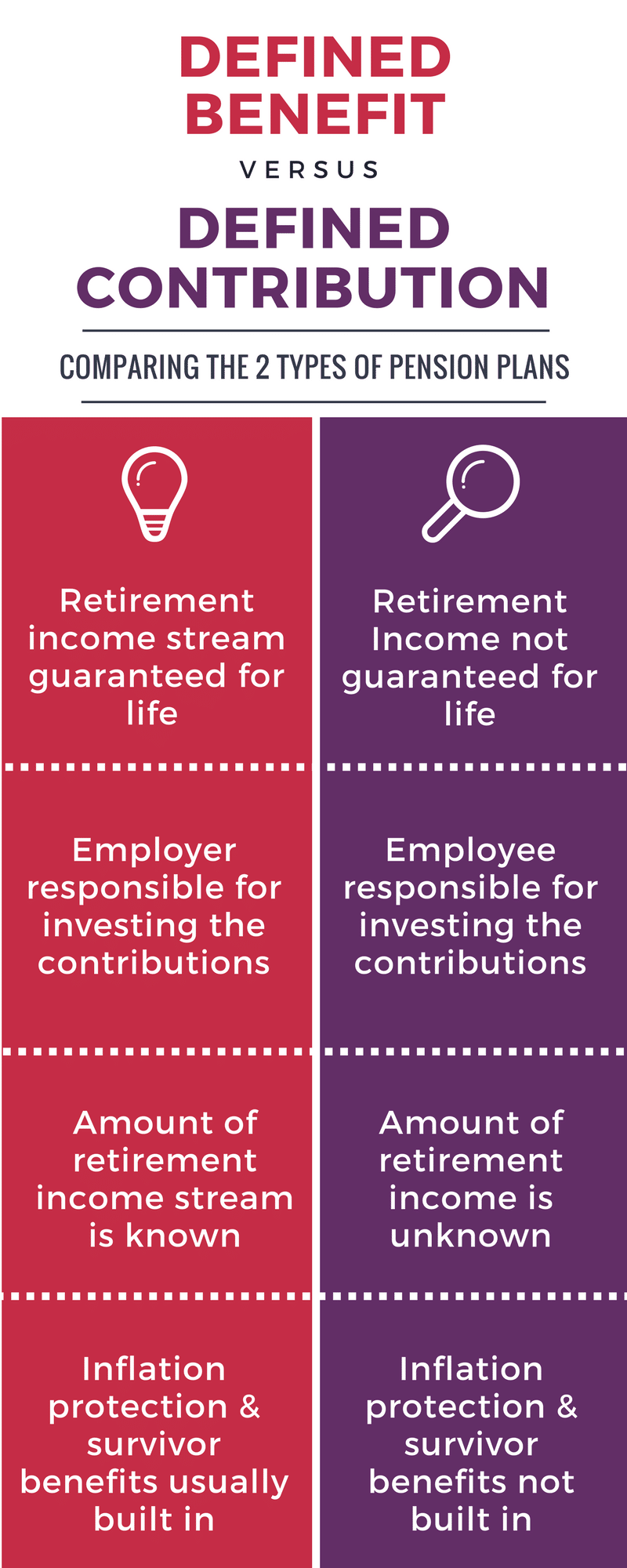

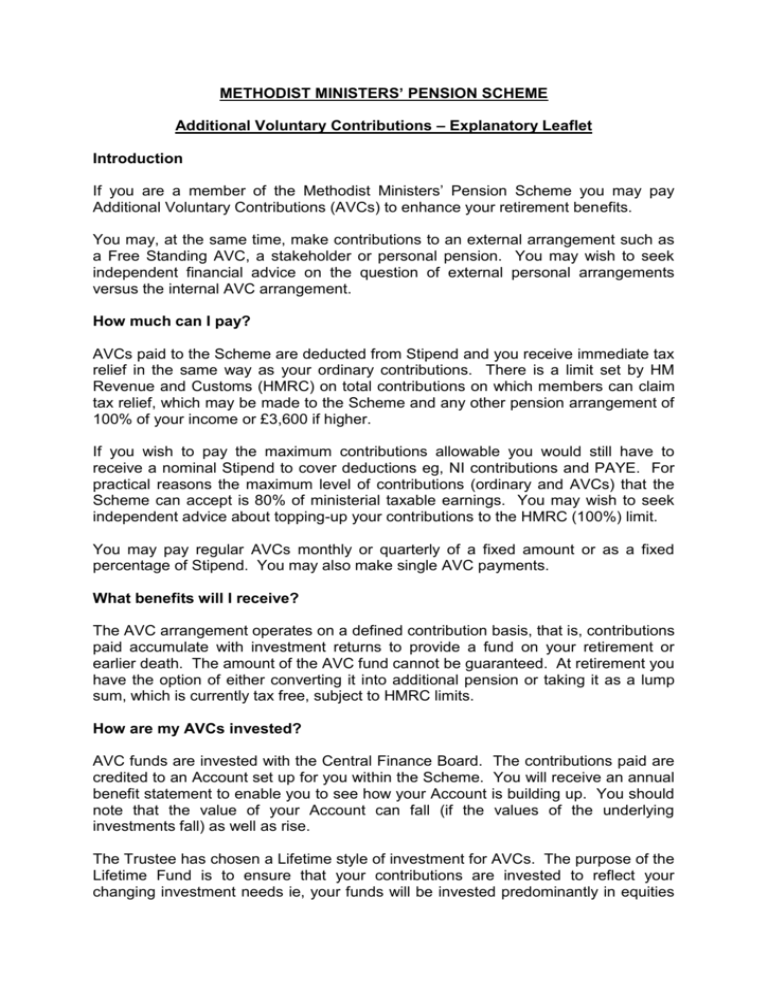

Defined contribution schemes - The Pensions Authority Defined contribution (DC) schemes are occupational pension schemes where your own contributions and your employer’s contributions are both invested and the proceeds used to buy a pension and/or other benefits at retirement. The value of the ultimate benefits payable from the DC scheme depends on the amount of contributions paid, the investment return achieved less …

Defined contribution pension death

NYS Voluntary Defined Contribution Plan 20/02/2022 · Having offered a defined-contribution retirement option since the 1960s, the SUNY Optional Retirement Plan (ORP) was selected to manage the new VDC plan for other New York public employees. Large majorities of professional employees in both the SUNY system and the CUNY system have chosen the SUNY ORP over the standard pension mandated for other … Death Benefits - Defined Contribution Schemes Death Benefits - Defined Contribution Schemes. ... How pension death benefits are treated depends on the age at death and the timeframe with which any death benefits are paid out. Death benefits and the Lifetime Allowance A lifetime allowance charge may apply to benefits where: What is a defined contribution pension? | PensionBee What is a defined contribution pension? A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions.

Defined contribution pension death. Triviality and commuting small pensions for cash Small pensions from both defined benefit and/or defined contribution schemes, payable to a survivor on the death of member can be commuted and paid as a one off lump sum (known as a trivial commutation lump sum death benefit) provided the value of the lump sum in each scheme is no more than £30,000. Defined Contribution Pension schemes What is a defined contribution pension ? Defined contribution pensions can be: workplace pension schemes set up by your employer, or private pension schemes set up by you. If you're a member of a pension scheme through your workplace, then your employer usually deducts your pension contributions from your salary before it is taxed. Death benefits for defined benefit schemes Defined benefit schemes usually offer lump sum death benefits and scheme pension. The lump sum death benefit will usually be a set amount or a multiple of salary. Lump sum death benefits are tax-free if the member dies under age 75, the lump sum is within the member's lifetime allowance and it is paid within two years of the scheme ... Tax on a private pension you inherit - GOV.UK A pension from a defined benefit pot can usually only be paid to a dependant of the person who died, for example a husband, wife, civil partner or child under 23. It can sometimes be paid to...

Beneficiaries Should Know Their Rights If you have a spouse when you retire, your benefits will be paid as a joint-and-survivor pension, unless you both decide to waive this right. After your death, your surviving spouse will receive at least 60 percent of the monthly pension that was paid to you—and it continues if he or she re-marries. Types of private pensions - GOV.UK defined benefit - usually a workplace pension based on your salary and how long you’ve worked for your employer Defined contribution pension schemes These are usually either personal or ... Pension death benefits 'indefensibly generous' Rule changes in 2015 allowed any unused cash left in a defined contribution personal pension to be passed to beneficiaries and heirs tax free if the pension holder died before the age of 75. Retirement Topics - Death | Internal Revenue Service Sep 27, 2021 · Retirement Topics - Death. When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant’s designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity). ERISA protects surviving spouses of deceased participants who had earned a vested pension benefit before their death.

Pension Plan Definition 30/08/2021 · Allocated Funding Instrument: A specific type of insurance or annuity contract that pension plans use to purchase retirement benefits incrementally. The allocated funding instrument is funded with ... Pension Funds Novartis · Death Spouse's pension (where applicable also for divorced persons) Domestic partner's pension Orphan's pension Lump sum payments If an insured person dies before reaching the age of 65, a lump sum on death will be paid out to the beneficiary. Provisions stipulated in the regulation Regulations of Novartis Pension Fund 1 (Art. 10 Para. 3 to Art. 15, Art. PDF Defined Contribution Pension Plan Death Benefit Application Defined Contribution Pension Plan Death Benefit Application _____ Complete all applicable sections and return pages 1-3 to: Southern California Pipe Trades Administrative Corporation Defined Contribution Department 501 Shatto Place, 5th Floor Los Angeles, CA 90020 Save "Your Rollover Options" for your records. (800) 595-7473 OR (213) 385-6161 Defined contribution pensions - BDO Relaxation of tax charges for pension funds on death after age 75 It has long been the case that if an individual dies before taking any pension benefits (and before age 75), the fund remains outside the individual's estate for inheritance tax (IHT) purposes and there is no exit charge on funds paid to their nominated beneficiaries.

What happens to your pension when you die? | PensionBee Jul 07, 2021 · Defined contribution pensions. The main pension rule governing defined contribution pensions in death is your age when you die and whether you’ve already started drawing your pension. If you die before your 75th birthday and haven’t started drawing your pension it can be passed to your beneficiaries tax-free.

Defined Contribution Plan Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned.

Employee Retirement | dchr Employer Contribution Employee Requirements; 401(a) Defined Contribution Pension Plan for Benefits-Eligible Employees Hired on or After October 1, 1987: 100 percent employer funded: 5 percent of the base salary (5.5 percent for Corrections Officers) beginning the first pay period after one year of service.

Defined Contribution Pension Plan in Canada: Complete Guide The Defined Contribution Pension Plan in Canada is one of the two popular pension plans used by Canadians. A Defined Benefit Pension Plan (DBPP) differs from a Defined Contribution Pension Plan in several ways: The company offering DBPP guarantees a fixed amount of income for their employees after their retirement. The DBPP is not a portable plan.

Pensions and ill-health - Adviserzone The onset of ill-health can impact on pension funding and the annual allowance. Accessing pension benefits flexibly - for example, via flexi-access drawdown or UFPLS - will trigger the money purchase annual allowance (MPAA) which limits funding to defined contribution pension schemes to £4,000 per tax year and no 'carry forward' available.

Considering a pension transfer: defined benefit | FCA 19/07/2021 · In a defined contribution (DC) pension, you invest funds to build up a personal pot of money. You can choose how to use your pot to give you allowable tax-free lump sums and your retirement income. The value of your pension pot is affected by changes in the value of the assets you invest in - such as shares, bonds and property - and it will go up and down in value. …

Georgia Defined Contribution Plan - Employees' Retirement ... 20/11/2017 · Georgia Defined Contribution Plan – FY 2022 Interest Crediting Rate During the monthly meeting on April 15, 2021, the Investment Committee of the Employees’ Retirement System (ERS) Board of Trustees considered the Interest Crediting Rate for the Georgia Defined Contribution Plan (GDCP) for FY 2022.

Defined-Contribution Plan Definition The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date.

What happens to your pension when you die? - Aviva A defined contribution pension — a pension that's based on how much has been paid into it — will normally pay the value of your pension pot in a lump sum to your dependants. If you die before age 75, benefits under money purchase schemes can usually be passed on to your beneficiaries free of tax.

DEFINED CONTRIBUTION PENSION - A Complete Guide As with a defined contribution pension, your contributions are tax-free. But like a defined benefit pension, you are guaranteed a certain amount by the pension provider when you ultimately retire. The pension provider has a team of investment managers to earn a return. They put your money to work by investing in shares and other assets.

Death benefits from defined contribution schemes - Pru-Adviser This article focuses on the death benefits available from defined contribution schemes. The death benefits payable are based on a number of factors. These include the type of scheme, who is to receive the benefit and how they are to be paid, if the death is before or after crystallisation and if the death is before or after age 75. What can a defined contribution scheme …

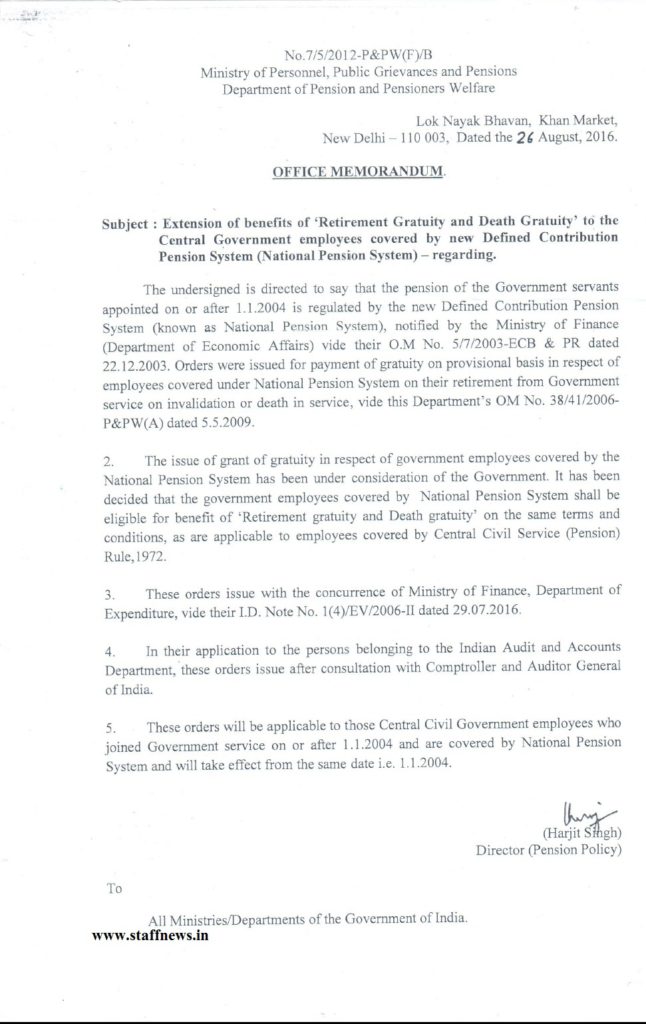

Death benefits from a defined benefit pension scheme | Tax ... Death benefits from a defined benefit pension scheme Introduction On the death of a scheme member or a beneficiary, a registered pension scheme is only authorised to pay out benefits to a beneficiary either as a pension death benefit or as a lump sum death benefit.

Pension transfer for defined contribution pensions ... You can normally move a defined contribution pension at any time before you begin taking money from it. You can check with your provider if there are any restrictions for your specific case. In many cases, you can also transfer even after you’ve started to take money from the pension. But in some cases the scheme might not allow this. It’s a good idea to check this before you …

Transfer of Pension Assets - Dynamic Defined Benefit Pension Plan. This is the type of plan where a formula outlines how much you will be paid at retirement. As with Defined Contribution plans, the benefit received by the widow/widower depends on if the death occurred before or after the pension payments begin. Death before pension payments begin. Two options may be available.

MTA Defined Benefit Pension Plan - MNRR effective contribution date of October 1, 2005, or ... the MTA Defined Benefit Pension Plan. You must file a form (supplied by MN) with Metro-North Human Resources Department. You must take this action within forty-five (45) days of final ratification. 7 Overtime earnings All overtime earnings are pensionable. 8 How Service Counts A full year consists of 2,080 hours or 260 …

What happens to my pension when I die? | MoneyHelper Defined benefit pension schemes might also pay a refund of the contributions paid by the member, if the member dies before starting to draw their pension. This is subject to the scheme's rules. Interest might also be added to the refund of contributions under some scheme's rules. Pension protection lump sum

Inherited Pension Benefit Payments From Deceased Parents Apr 25, 2021 · Defined-Contribution Pension . With a defined-contribution plan, such as a 401(k), the beneficiary can access remaining funds in the retirement account via a gradual drawdown, lump sum payment, or ...

PDF Fugro Holdings Limited Pension and Death Benefit Scheme ... Fugro Holdings Limited Pension and Death Benefit Scheme - Defined contribution section Annual statement by the Chair of the Trustee for the year to 31 December 2019 Summary I, along with my fellow Trustee Directors (the Trustee), am responsible for looking after the money you and other members have invested in our Scheme.

Reaching age 75: our top five frequently asked ... - Pensions Yes. If the product allows the individual to remain invested after age 75 then it is possible to take a pension commencement lump sum after age 75. The individual should consider the taxation of death benefits as on death after age 75, the beneficiary will be subject to income tax on any benefits taken.

What is a defined contribution pension? | PensionBee What is a defined contribution pension? A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions.

Death Benefits - Defined Contribution Schemes Death Benefits - Defined Contribution Schemes. ... How pension death benefits are treated depends on the age at death and the timeframe with which any death benefits are paid out. Death benefits and the Lifetime Allowance A lifetime allowance charge may apply to benefits where:

NYS Voluntary Defined Contribution Plan 20/02/2022 · Having offered a defined-contribution retirement option since the 1960s, the SUNY Optional Retirement Plan (ORP) was selected to manage the new VDC plan for other New York public employees. Large majorities of professional employees in both the SUNY system and the CUNY system have chosen the SUNY ORP over the standard pension mandated for other …

0 Response to "42 defined contribution pension death"

Post a Comment